Read in the Digest:

- Bitcoin (BTC) trades sideways as the market anticipates September CPI reports.

- New Ethereum (ETH) addresses surge to a yearly high over the weekend.

- OpenSea’s CFO steps down ten months after assuming the position.

- Huobi Founder sells 100% stake – Exchange to focus on global expansion.

- Dapper bans NFT operations for Russian users following new E.U. sanctions.

Bitcoin (BTC) Trades Sideways as the Market Anticipates September CPI Reports

The crypto market traded sideways over the weekend as the Consumer Price Index (CPI) takes the top billing for the coming days. On Thursday, October 13th, the Bureau of Labor Statistics (BLS) is expected to release its CPI data for September.

The CPI data is expected to dictate how aggressively the Federal Reserve will approach its plans for the interest rate. Stocks in Asia are bracing for what could be another downtrend as China and France prepare to release their CPIs for September.

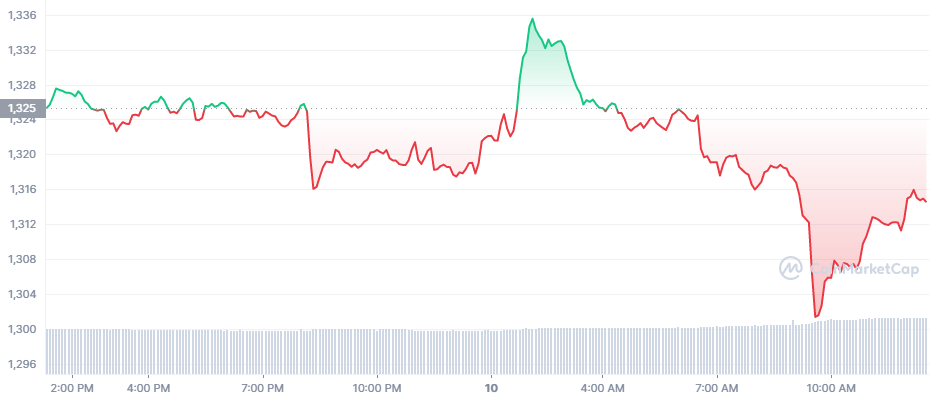

Bitcoin continues to operate in the $18-$21k range it has occupied in recent months. Bitcoin currently trades at $19,350 at the time of writing, while Ethereum (ETH), the world’s second-largest crypto, is trading at $1,320.

The 24 hour price chart for Bitcoin (BTC). Source: CoinMarketCap

The 24 hour price chart for Ethereum (ETH). Source: CoinMarketCap

Flipsider:

- Despite the crypto market trading sideways, Terra Classic (LUNC) spiked by more than 6% today in response to a new proposal that aims to re-peg the stablecoin.

The 24 hour price chart for Terra Classic (LUNC). Source: CoinMarketCap

Why You Should Care

The crypto market continues to experience challenges as the world witnesses the most intense tightening of global monetary policy in more than three decades.

New Ethereum (ETH) Addresses Surge to Yearly High Over the Weekend

Despite trading sideways over the weekend, Ethereum experienced a surge in the number of new active wallet addresses. Data tracker Santiment, reports that, on Saturday, October 8th, 135,780 new ETH addresses were added to the network.

Santiment revealed that, over the course of the weekend, the Ethereum network recorded the highest number of new addresses created so far in 2022, and 11.1% more network growth than the next highest of 2022, which occurred on January 3rd.

The launch of the XEN crypto is a major reason for the surge. XEN launched on October 8th, allowing anyone to mine the XEN tokens for just their gas fees (in ETH).

In the 24 hours after XEN launched, more than $1.8 million in ETH was burned, as the project accounted for more than 43% of the overall activity on the Ethereum network. The project has also managed to reduce Ethereum’s inflation from 0.21%, to $0.12%.

Flipsider:

- Although there has been a substantial increase in activity on Ethereum, the price of ETH has not met the community’s expectations of a boost since the mainnet merge.

Why You Should Care

The spike in newly created Ethereum addresses is due in part to the massive attention received by XEN as it hopes to increase the rate of Ether’s deflation.

OpenSea’s CFO Steps Down Ten Months After Assuming the Position

The “Great Crypto Resignation” continues, with Brian Roberts, the Chief Financial Officer (CFO) of leading non-fungible token (NFT) marketplace OpenSea, becoming the latest to tender his resignation.

Roberts, who had served as the CFO of OpenSea for ten months, took to LinkedIn on October 7th to announce that he would be stepping down. According to Roberts, it was time for him to “come ashore” from the “open seas”, but omitted a precise reason for the change. OpenSea’s Vice President of Finance Justin Jow is expected to assume the newly vacant position.

Ryan Foutty, the Vice President of Business Development at OpenSea, announced his resignation on the same day as Roberts, marking the end of 18 months of service in OpenSea.

Before Roberts’ appointment as OpenSea’s first finance hire in December 2021, he worked at Lyft for seven years. He also held several corporate roles at Walmart and Mircosoft, serving on the Board of Trustee at Fred Hutch.

Flipsider:

- Although the post didn’t include a reason for Roberts’ abrupt departure, he revealed that he would remain as the firm’s advisor, stating that he is still bullish for the company’s future, NFTs, and Web 3.0.

Why You Should Care

The resignation of top execs in crypto is one of the many havocs instigated by the 2022 crypto winter.

Huobi Founder Sells 100% Stake – Exchange to Focus on Global Expansion

On October 8th, Crypto exchange Huobi Global announced that its Founder Leon Li had sold his controlling stake in the compay to Hong Kong-based investment company About Capital Management’s M&A fund.

In a blog post, the exchange stated that the transition would have no effect on the core operation or business management teams. Under the new ownership, Huobi plans to embrace a series of new international brand promotion and business expansion initiatives.

The crypto exchange also intends to build a global strategic advisory board “led by leading industry figures”, and will look to increase its competitiveness by setting up margin and risk provision funds.

The move follows months of rumors that Li had been seeking to sell nearly 60% of his stake in Huobi for at least $1 billion, which was valued at $3 billion. The terms of the deal with About Capital have not been disclosed.

Flipsider:

- Despite reports that Tron Founder Justin Sun will assume the role of shadow owner of Huobi after the deal, Sun has refuted all claims of a buyout.

Why You Should Care

With the change in leadership, Huobi aims to provide better trading and investment services to international investors.

Dapper Bans NFT Operations for Russian Users Following New E.U. Sanctions

Dapper Labs, the creators of the Flow blockchain network and NFT projects like Cryptokitties and NBA Top Shot, have blocked Russian users from operating on the platform following new European Union sanctions.

Confirming the news, Dapper Labs announced that accounts linked to Russia will no longer be able to sell, buy, or otherwise transfer non-fungible tokens (NFTs) on the platform.

Dapper Labs explained that the fresh sanctions against Russia and Russian nationals includes finance-related restrictions. The sanctions were approved by Brussels on Thursday, October 6th following Russia’s escalation of conflict in Ukraine.

In line with the sanctions, Dapper Labs has also frozen the funds of all accounts suspected to be connected with Russia “irrespective of the amount”. The sanction also prevents Dapper from providing account or custody services to users in Russia.

Flipsider:

- Bypassing the sanctions, a recent report revealed that pro-Russian groups have been using crypto often to fund $4 million worth of paramilitary operations in Ukraine.

Why You Should Care

Dapper Labs’ adherence to the recently imposed sanctions means that Russian accounts can no longer access Dapper’s services.

Flipsider News, zz_index, zz_popular, zz_top, ZZZ Editors’ Picks, ZZZ Native, Bitcoin (BTC), Dapper Labs, Ethereum (ETH), OpenseaRead More