Read in the Digest

- Goldman Sachs sees Bitcoin at $100k, institutional inflow at record $9.3 billion in 2021, NYDIG Bitcoin ETF delayed by two months.

- OpenSea hits $13 billion valuation, Bored Ape Yacht Club hits $1 billion in Sales, Nvidia enters the metaverse.

- El Salvador prepares bills for Bitcoin bonds, China releases digital yuan wallet apps.

- Ethereum’s Proof-of-Stake transition is 50% complete – Vitalik Buterin.

Goldman Sachs Sees Bitcoin at $100k, Institutional Inflow at Record $9.3 Billion in 2021, NYDIG Bitcoin ETF Delayed by Two Months

Despite the recent underperformance of the crypto markets, global investment banking giant, Goldman Sachs, has predicted that Bitcoin could hit $100,000. Goldman Sachs explained that if Bitcoin continues shaving off gold’s market share, its value could reach six figures in 2022.

Zach Pandl, Goldman Sachs’ co-head of foreign exchange strategy, explained that Bitcoin could attain the lauded feat as a “byproduct” of more adoption. If the public turns its $2.6 trillion of gold investment to Bitcoin, its place as a “store of value” could see it rise to $100k.

The adoption of crypto by institutions spread like wildfire in 2021. In its annual report, CoinShares revealed that the institutional inflow into the crypto market hit a record $9.3 billion in 2021 compared to the $6.8 billion recorded in 2020. In addition to this, the total assets under management (AUM) at the end of 2021 was at $62.5 billion, versus just $2.8 billion in 2020.

Flipsider:

- Although Bitcoin continues to succeed institutionally, the SEC has delayed its decision on the NYDIG Bitcoin ETF, offered by Stone Ridge Holdings Group, by two months.

- The crypto markets have also continued to decline, and are now valued at $2.2 trillion, 26% less than they were in November when they peaked at $3 trillion.

Why You Should Care

Although Bitcoin has underperformed recently, the future of the asset looks bright amid increasing inclusion in the financial industry.

OpenSea Hits $13 Billion Valuation, Bored Ape Yacht Club Hits $1 Billion in Sales, Nvidia Enters the Metaverse

OpenSea, a peer-to-peer NFT marketplace, announced that it has hit a staggering $13.3 billion valuation. On January 4th, OpenSea revealed that it had completed a $300 million Series C funding round with which it plans to accelerate its product development and invest in the wider NFT and Web 3.0 communities.

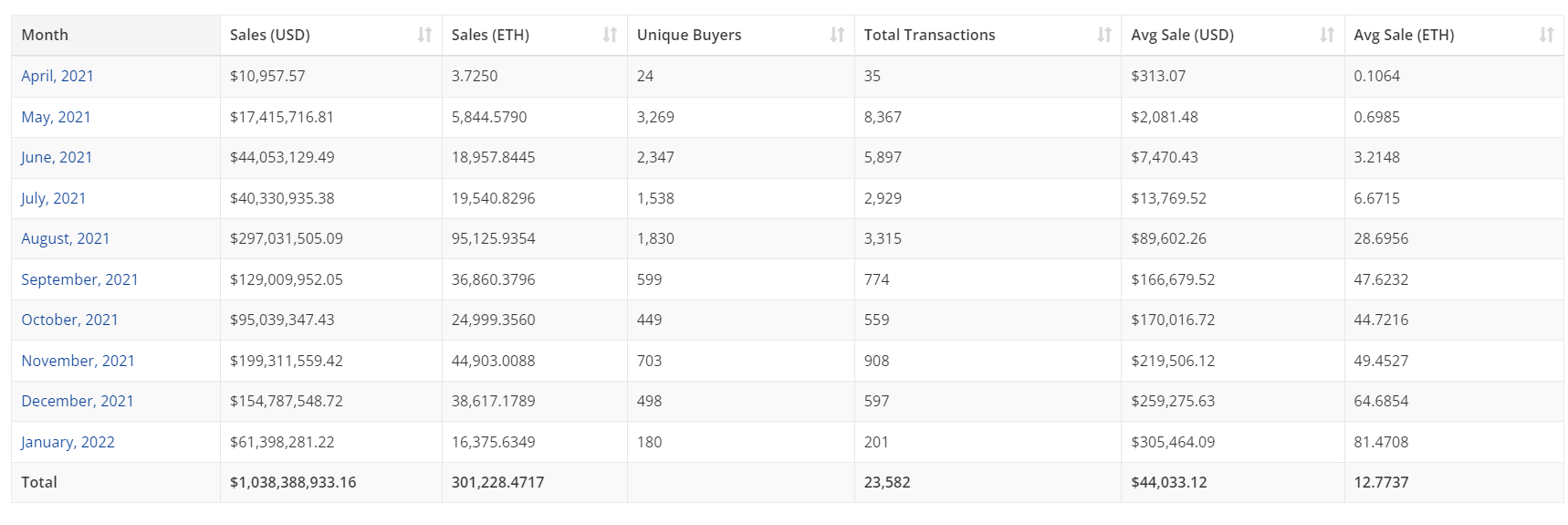

In other good news for the industry, one of the most popular NFT collections, the Bored Ape Yacht Club, has hit yet another milestone. The NFT project consisting of 10,000 unique apes has now recorded cumulative sale statistics of over $1 billion with an average sale price of $44,033.12.

Global graphics processing unit manufacturer, NVIDIA, has joined the growing list of companies joining the metaverse. While not building a metaverse of its own, NVIDIA will be distributing free versions of its “Omniverse” software to support content creators in building their own worlds.

Flipsider:

- Building on 2021’s success, the Meta Super League, a new NFT initiative allowing investors to acquire their own bespoke sports team, has now launched, bringing true competition to the metaverse.

Why You Should Care

As the metaverse and NFTs permeate into different industries, we could see greater adoption and increased use cases for them in 2022.

El Salvador Prepares Bills for Bitcoin Bonds, China Releases Digital Yuan Wallet Apps

El Salvador, the first country in the world to make Bitcoin legal tender, has announced plans to issue Bitcoin Bonds. Led by enigmatic its President, Nayib Bukele, El Salvador is preparing 20 bills designed to provide a legal framework for Bitcoin Bonds to further the nation’s plans to build Bitcoin City.

El Salvador’s finance minister, Alejandro Zelaya, announced that the bills would be sent to Congress “to provide a legal structure and legal certainty to everyone who buys the Bitcoin bond.”

Despite its cryptocurrency crackdown, China has been leading the race to develop a sovereign digital currency. Having initiated its main testing in 2019, China has now released the digital yuan wallet app on Apple and Android app stores.

With the digital yuan wallet, which is currently in its early trial stage, users can register to use the app in select cities, such as Shanghai and Xian. China has announced that it will become commercially available to foreign visitors at Winter Olympics venues this February.

Flipsider:

- Over the past few weeks, dozens of El Salvadorians have complained about losing a combined $90,000 in Bitcoin from their government Chivo wallets.

Why You Should Care

The far-reaching plans of El Salvador could build a pedestal from which countries can grow the global adoption of Bitcoin.

Ethereum’s Proof-of-Stake Transition Is 50% Complete – Vitalik Buterin

As part of a recent podcast appearance, Ethereum co-founder Vitalik Buterin provided updates on Ethereum’s transition to the proof-of-stake mechanism. According to Buterin, development efforts on the PoS transition are more than 50% done.

According to Buterin, the Ethereum network would need to become “more agile and more lightweight” in regards its blockchain data management capabilities to be capable of achieving greater scalability and decentralization.

However, he added that the first steps towards achieving this scalability have already been successfully implemented. Buterin explained that he and his team will be enabling certain modules to allow more users to run nodes over the coming weeks and months.

Buterin underlines that when the Ethereum network is merged, it would mark that the transition is 80% complete. The next phase would then enable more users to run nodes on the network. The ultimate goal for Ethereum, in Buterin’s words, is to become “simpler and simpler over time.”

Flipsider:

- According to Buterin, the roadmap will take another six years to complete.

Why You Should Care

With Ethereum 2.0 now closer than ever before, it will be interesting to see how the future plays out for the Ethereum network.

Market News, Bitcoin, Ethereum, Opensea, vitalik buterinRead More