The UK’s financial technology sector is planning to boost professional hiring by 32% this year, defying economic uncertainty and lackluster venture capital flows, according to new data from recruitment firm Morgan McKinley and analytics company Vacancysoft.

UK Fintech Sector Plans 32% Hiring Surge Despite Market Headwinds

The expansion comes as regulatory scrutiny intensifies and cybersecurity threats proliferate across the industry. While elevated market volatility continues to dampen investor confidence and venture funding remains below historical averages, fintech companies are pressing ahead with targeted recruitment strategies focused on compliance and technology infrastructure.

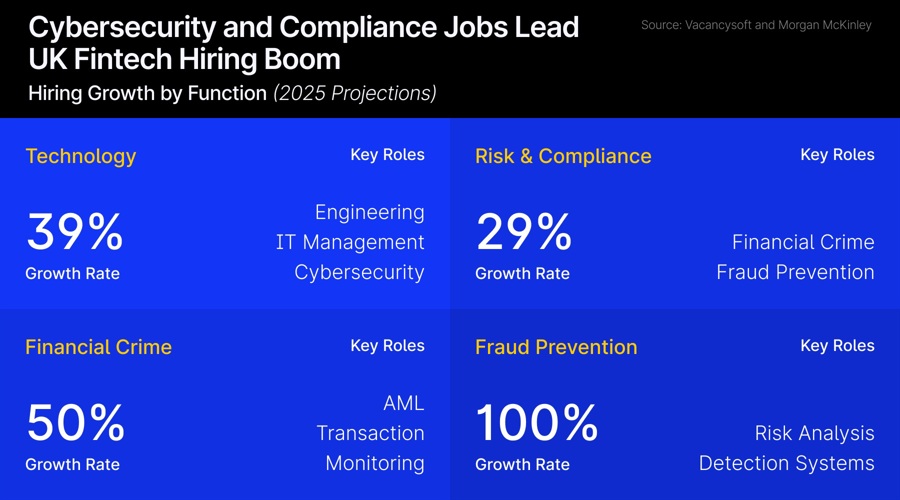

Risk and compliance positions are expected to grow by 29% in 2025, representing the third straight year of expansion in this area. Financial crime roles face particularly acute demand, with hiring projected to jump 50% as firms grapple with increasingly complex regulatory requirements.

Fraud prevention positions are set to double this year as companies strengthen their defenses against sophisticated threats. The surge reflects a broader shift in regulatory expectations from basic compliance to active governance frameworks.

“The data tells a clear story: despite subdued venture capital flows, demand for specialist talent remains robust,” said Mark Astbury, Director at Morgan McKinley UK. “This isn’t a hype-driven rebound, it’s a grounded response to real-world pressures.”

You may also like: AI Adoption in Fintech: “70% of Finance Professionals Utilize Automation for CV Screening”

Technology Roles Lead Growth Trajectory

Technology hiring is forecast to expand by 39%, driven primarily by engineering, IT management, and cybersecurity positions. London maintains its dominance in this sector, with recruitment boosted by the upcoming Cyber Security and Resilience Bill.

As fintech firms replace outdated systems and meet evolving compliance standards, system resilience and threat mitigation capabilities have become critical priorities. The emphasis on infrastructure modernization reflects an industry transitioning from rapid scaling to more deliberate expansion strategies.

Mixed Strategies Across Industry Players

Companies are adopting divergent approaches to workforce expansion. Several major firms, including FNZ, Wise, Deel, and Ebury Partners, are increasing headcount by 40% to 120% as they capitalize on product momentum and international growth opportunities.

Conversely, other fintech companies are taking a more conservative stance, scaling back recruitment due to cost pressures and challenging fundraising conditions. However, even cautious firms are maintaining investment in high-impact roles covering compliance, product engineering, and IT security.

The hiring data reveals a sector maturing beyond its startup phase. Deel leads vacancy projections with an estimated 675 professional positions in 2025, up from 477 in 2024. Checkout and Wise follow with 660 and 600 projected vacancies, respectively.

Strategic Workforce Investment

The recruitment surge represents a fundamental shift in fintech talent acquisition, moving from reactive hiring to strategic workforce planning. Companies are channeling resources into specialized roles that address regulatory requirements, security vulnerabilities, and operational scaling needs.

“Fintech firms are hiring to meet rising regulatory expectations as they grow, to counter increasingly sophisticated financial threats, and to build more resilient digital infrastructure,” Astbury explained.

While generalist positions remain stable or face cost review, the emphasis on compliance and cybersecurity professionals signals an industry responding to both market opportunities and regulatory obligations. The recruitment trend suggests fintech companies are prioritizing sustainable growth over rapid expansion as they navigate an increasingly complex operating environment.

The hiring outlook reflects broader industry maturation as fintech firms transition from startup status to established financial services providers, requiring more sophisticated organizational structures and risk management capabilities to support continued growth.

Fintech Investment Slumps to Seven-Year Low

The current hiring surge unfolds against the backdrop of fintech’s most challenging investment climate since 2017. Global fintech funding collapsed to $95.6 billion in 2024, representing a dramatic retreat from the sector’s peak years, when venture capital flowed freely into emerging financial technologies.

While activity declined throughout the year, falling from $51.7 billion in H1 to $43.9 billion in H2, Q4 showed signs of stabilization, with funding rising to $25.9 billion from $18 billion in Q3. Deal values in M&A nearly doubled quarter-over-quarter, and venture capital activity saw a modest uptick, reflecting cautious optimism among investors.

Regional data showed the Americas leading with $63.8 billion in investment, of which $50.7 billion came from the United States. The EMEA region attracted $20.3 billion, and the Asia-Pacific region reported $11.4 billion. The UK remained Europe’s top fintech hub, receiving more capital than all other European countries combined.

This article was written by Damian Chmiel at www.financemagnates.com.FinTechRead More

You might also be interested in reading Binance ceases support for deposits and withdrawals of suspended Multichain-bridged tokens.