Barely a month after the landmark acquisition of OANDA by the Czech-based prop trading giant FTMO, the latter is boosting its prop trading business. The latest developments are a new prop trading community brand and a loyalty program, which signal the independence of the prop trading business unit in OANDA’s offerings.

FTMO-OANDA Post Acquisition

“Congratulations to OANDA for the official launch of the OANDA Prop Trader Community + Loyalty Program! They definitely raised the game of what it means to run a loyalty program professionally – having deeply integrated CRM automation to reward users for purchasing, referring, and advocating,” Desmond Leong, Former Forex and CFD Specialist at Forex Australia, mentioned in a post on LinkedIn.

“Tie that in with a full-fledge store so their users can redeem discount coupons using their hard-earned coins, and man, it’s an absolute beauty.”

The acquisition deal marked a new phase in the prop trading space, as companies strive to comply with the new regulations that are fast catching up with the industry. The strict regulations have now forced companies to turn to established multi-asset trading brands to ensure compliance.

Landmark Acquisition in the Prop Industry

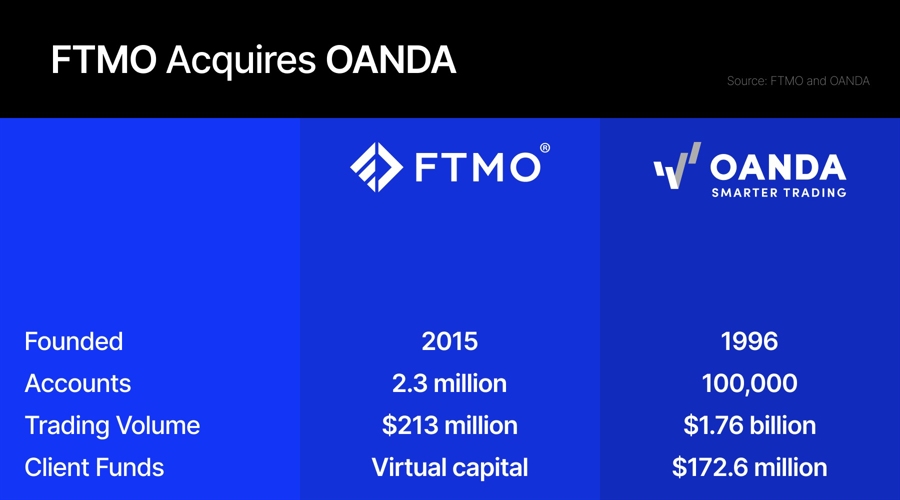

CVC Asia Fund IV agreed to sell OANDA Global Corporation to FTMO Group. The deal is subject to regulatory approvals, and the financial terms were not disclosed. OANDA, founded in 1996, offers a digital trading platform for retail and corporate clients. It offers multi-asset trading, currency data, and analytics. The company operates in major financial hubs, including New York, London, and Tokyo.

@FTMO_com Acquires Broker OANDA! This strategic purchase marks a significant step for FTMO in expanding its footprint in the trading world. Meanwhile, @FundedNext made waves at the iFX EXPO in Dubai earlier this January, revealing their plans to enter the broker industry.…

— Prop Firm Markets (@PropFirmMarkets) February 3, 2025

Previously, Finance Magnates reported that FTMO made nearly CZK 5 billion (over $213 million) in revenue in 2023, a 20% increase. Its EBITDA for the year also reached nearly $100 million. Although the financial consideration of the deal was not disclosed, Finance Magnates earlier reported that CVC bought OANDA in 2018 at a valuation of about $162.5 million.

This article was written by Jared Kirui at www.financemagnates.com.Retail FXRead More

You might also be interested in reading Web3 innovations are replacing middlemen with middleware protocols.