IG Group Holdings plc (LSEG: IGG) announced today (Monday) the commencement of the third tranche of its share buyback program, allocating up to £50 million for capital reduction purposes.

IG Group Launches £50 Million Third Tranche of Share Buyback Program

This latest initiative follows the company’s initial £150 million program announcement in July 2024 and a £50 million extension revealed in January 2025.

The company has appointed Morgan Stanley & Co. International Plc to execute the third tranche independently, which will run from February 3, 2025, through June 10, 2025.

The buyback will operate within the parameters approved at IG Group’s September 2024 annual general meeting, with a maximum of 28,922,621 shares available for purchase under this tranche.

IG’s previous share buyback program of this size began in late 2023 and concluded at the end of July 2024, successfully repurchasing £150 million worth of shares. Following that outcome, the company decided to initiate another program of the same magnitude.

IG Group, which provides trading access to approximately 19,000 financial markets worldwide, recently also announced results for the first half of fiscal 2025, ending on 30 November 2023. The company reported total revenue of £522.5 million and net trading volume of £451.7 million.

“Our focus remains on executing against the priorities we outlined in July 2024, which are to improve our product, embed a high-performance culture across the business and enhance efficiency,” said Breon Corcoran, IG Group’s CEO. “Current trading has been satisfactory, and we remain confident of meeting consensus revenue and profit before tax expectations in FY25.”

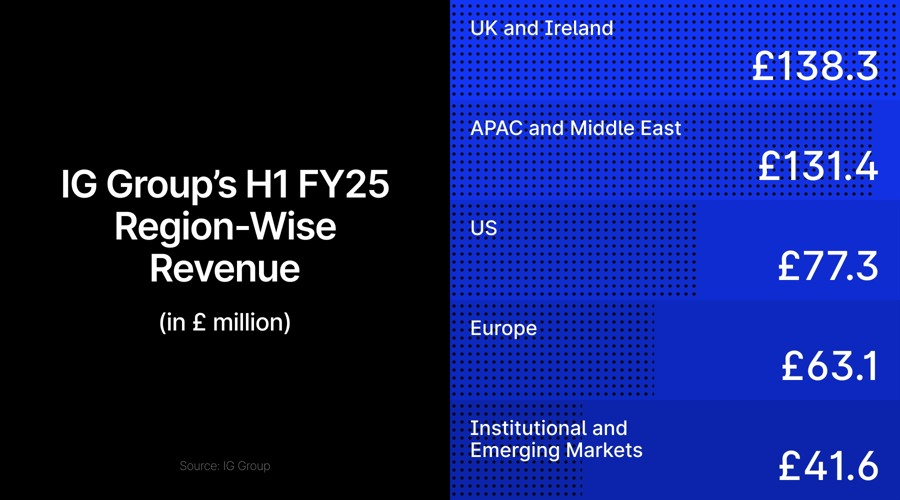

APAC Revenue Challenges UK Dominance

The report also indicated that the company now earns more over-the-counter (OTC) revenue from the APAC and Middle East regions than from its domestic market in the UK and Ireland.

Interim results showed that the London-listed broker has reorganized its operations into five geographically defined divisions: UK and Ireland, APAC and Middle East, United States, Europe, and Institutional and Emerging Markets.

The UK and Ireland division reported total revenue of £138.3 million, reflecting an 11% increase compared to the previous year. APAC and the Middle East emerged as the company’s second-largest market, contributing £131.4 million in total revenue. However, when focusing on OTC revenue, APAC and the Middle East outpaced the UK and Ireland, generating £129.2 million compared to £127.4 million.

This article was written by Damian Chmiel at www.financemagnates.com.Retail FXRead More

You might also be interested in reading Avalanche Blockchain’s Largest-Ever Upgrade Goes Live on Testnet.