The Berlin-based digital trading platform Trade Republic today (Thursday) announced the launch of localized banking services in Italy, marking its second major market expansion this year. The company aims to strengthen its position across the continent with over €100 billion in assets under management (AUM).

Trade Republic Expands European Footprint with Italian Banking Launch

The German fintech is rolling out free current accounts with Italian IBANs and introducing automated tax submissions through the Regime Amministrato system, becoming the first international digital bank to offer this service.

“Millions of Europeans have realized that their governments lack solutions for one of the most critical challenges of our time. The pension gap is a predictable and measurable problem that continues to be overlooked in political discussions,” said Christian Hecker, Co-Founder of Trade Republic.

“With our full banking license, national branches, and proprietary infrastructure, we are committed to develop localized and cost-effective savings products to empower people to take control of their financial future.”

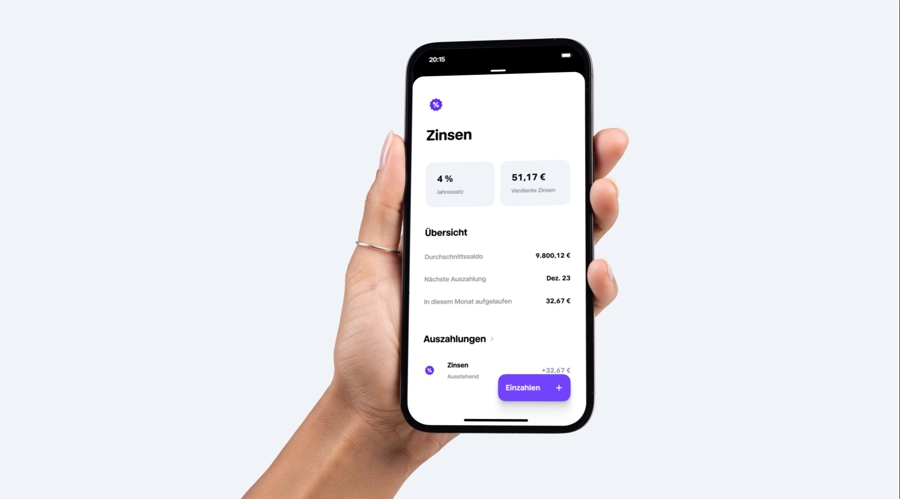

With 8 million customers across its markets. a number that was two times lower just a year ago, Trade Republic has emerged as a challenger to traditional banking institutions. The platform’s offering includes 3% annual interest on deposits, 1% “saveback” on card payments automatically reinvested into savings plans, and commission-free investment options.

The company’s international customer base now represents more than one-third of its total users, reflecting growing demand for accessible financial services across Europe.

“The pension gap is a European problem, but the solutions for our customers must be tailored to local needs,” said Julian Collin, General Manager of International Markets at Trade Republic. “Following France, Italy is the second major European market this year where we’ve localized our product. This is another step forward in driving European growth and increasing competition within the traditional banking sector.”

First France, Now Italy

This expansion comes just three weeks after a similar successful launch in France, highlighting the company’s aggressive growth strategy in key European markets.

The digital bank reported sustained profitability throughout 2024, while maintaining its competitive interest rate offering of 3% for deposit accounts, matching the ECB’s key rate.

The company recently enhanced its French market offerings with zero-commission investment plans compatible with PEA accounts, alongside the introduction of domestic banking services featuring local IBANs.

The pension gap is a European problem, but solutions need to be tailored to local needs. That’s why, starting today, our Italian customers will benefit from a fully localised product offering, including:- Italian IBANs, to easily get your salary on Trade Republic.- A current… pic.twitter.com/Y75WV9o1JB

— Trade Republic (@traderepublic) January 30, 2025

In early 2021, during the retail trading volatility events, the platform implemented temporary trading restrictions on certain high-volatility stocks, a decision that generated considerable user criticism at the time.

Currently, Trade Republic operates under the regulatory oversight of BaFin and Deutsche Bundesbank, serving clients across 17 European markets. Its product suite encompasses a range of investment vehicles, including equities, ETFs, fixed-income instruments, derivatives, and digital assets, with features such as fractional share ownership and automated investment plans.

This article was written by Damian Chmiel at www.financemagnates.com.Retail FXRead More

You might also be interested in reading ‘Privacy Is Not a Crime’ — Samourai Indictment Provokes Strong Reactions From Crypto Advocates.