There is an emerging trend in the retail forex and CFD brokerage sector. Today, Forex and CFD brokers find themselves fighting not only existing competition but also new competition in neo-brokers, crypto brokers and fintech apps, which outmatch them in terms of pocket depth, sizeable databases, and the number of products that is increasing by the day, really rewriting the rules of engagement for traditional forex and cfd brokers..

The Regulatory and Products Arms Race

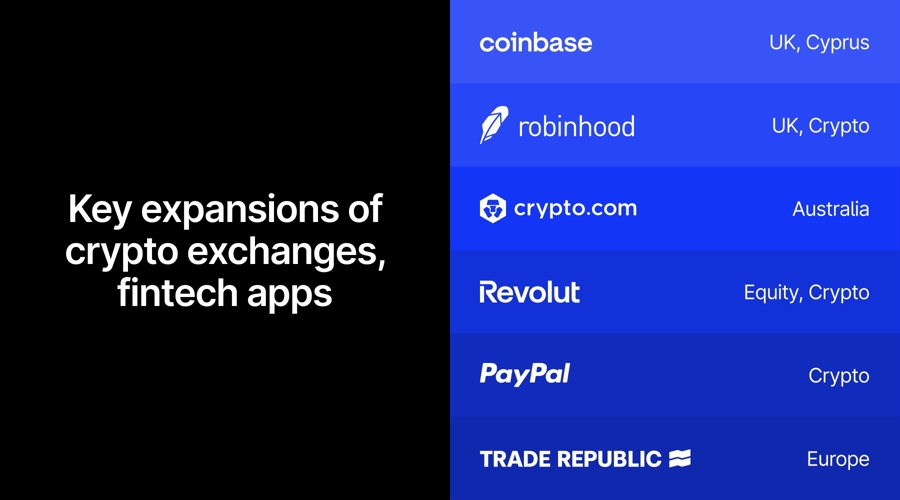

This competitive landscape has recently been reshaped by the aggressive geographic expansion of Coinbase, Robinhood, Crypto.com, Revolut, PayPal, and Trade Republic. Each of these firms has secured regulatory licenses in key markets that enable them to broaden their product offerings and appeal to a more extensive client base.

Coinbase: Having recently expanded in the UK and obtaining a Cyprus license, Coinbase is more than just a cryptocurrency exchange. These licenses allow it to offer a wider range of financial products, making it a formidable competitor to traditional FX/CFD brokers. Robinhood: Already having set up shop in the US, Robinhood is now taking a leap into the UK. With its commission-free model and user-friendly interface, it has already disrupted the brokerage industry. However, its entry into new markets, along with aggressively adopting crypto trading products and services, is likely to capture a significant share of retail investors who might otherwise have turned to FX/CFD brokers. Crypto.com: Crypto.com acquired an Australian company with an ASIC license and, thus, gains immediate regulatory approval to operate in a highly competitive market. This move allows it to introduce existing products—and potentially innovative new ones—to Australian consumers. Revolut: Initially Revolut was mobile banking app offering low cost currency exchange, bu now it has expanded its offerings to include equity and crypto trading. With licenses in multiple jurisdictions, it has a robust global presence and the ability to cross-sell financial services effectively. PayPal: Known for its dominance in digital payments, PayPal has ventured into the investment space with crypto trading and other financial products. Its established trust and massive user base make it a serious competitor. Trade Republic: A European neo broker, Trade Republic has rapidly gained traction by offering commission-free trading and intuitive platforms. Its expansion into new geographies in Europe outside their home country of Germany with a mobile first focus and adding savings products continues to challenge traditional brokers. Trade Republic just hit a milestone with 100B in assets and 8M user base.The ability of these companies to secure licenses in multiple jurisdictions not only signals their growth ambitions but also underscores their commitment to complying with local regulatory frameworks, an area where many FX/CFD brokers struggle.

Neo Brokers, Crypto Brokers and Fintech Apps: Their Strategic Advantage

Neo brokers and other fintech apps have entered the fray. These companies began by offering simplified solutions but have since diversified into investment products, including equities, crypto, and even providing fractional ownership of assets. Their strategic advantage lies in their:

Deep Pockets: These companies have substantial funding from venture capital and private equity and thus have the financial muscle to underwrite aggressive marketing campaigns and product development. Large Databases: These firms often leverage their large user bases—acquired through free or low-cost services—to cross-sell new financial products effectively. Mindshare: Many neo brokers and fintech apps have established themselves as household names, especially among younger, tech-savvy investors. These companies have focused on building a brand and not just focus their marketing on a digital acquisition strategy.Crypto venture funding hit $4B in Q4 2024—the highest since Q4 2022—with 687 deals.Web3 led the charge with 141 deals, while trading/brokerage investments dipped.DeFi stayed steady, and data analytics lagged.The landscape is evolving fast. 🌐📈 pic.twitter.com/kSXuz2UppZ

— Kyledoops (@kyledoops) January 14, 2025

Why FX/CFD Brokers Are at a Disadvantage

The traditional FX/CFD brokerage model is under threat because of several disadvantages:

High Customer Acquisition Costs: FX/CFD brokers face increasing advertising costs due to saturated markets and stricter regulations on promoting leveraged products. Additionally, if these new entrants spend more monies to advertise then acquisition costs will go up for Forex and CFD brokers. Additionally, they all can leverage their existing ecosystems to onboard customers at lower costs. Product Limitations: Many FX/CFD brokers focus primarily on trading instruments like forex, CFDs, and commodities. In contrast, neo brokers and fintech apps offer a broader range of services, including payments, banking, and diverse investment options. This more all-inclusive offering allows them to retain mindshare and customers. Technology Gap: Neo brokers and fintech apps have set a high bar for user experience with sleek, intuitive apps that appeal to modern investors. In contrast, many FX/CFD platforms lag in terms of technology and user interface. Regulatory Scrutiny: Leveraged trading products, a staple of FX/CFD brokers, are often subject to stricter regulatory oversight compared to the relatively straightforward investment products offered by neo brokers.FX/CFD Brokers: Adopt New Strategies

To compete effectively in this new landscape, FX/CFD brokers need to adopt a multi-pronged strategy:

Invest in Technology and User Experience: Upgrading trading platforms to match the user experience of fintech apps is crucial. Mobile-first designs, seamless onboarding, and AI-driven personalization can make a significant difference. And this is now the expectation of users. Have a goal of building something that the user will want to come back to often. Unique USP: To many brokers are using very similar messaging around “commission free”, “discounted spreads”, “free bonuses”, or “fast execution”. Traders and Investors have become numb to this messaging. Brokers must solve a pain point for users which can provide them with a unique USP against this new competition. Diversify Product Offerings: Brokers must move beyond traditional forex and CFDs. Adding equities, ETFs, and even crypto trading can attract a broader audience. Expand Geographically: Securing licenses in new markets can unlock growth opportunities. Brokers should prioritize regions with growing retail investment markets but less intense competition. But this will require focusing on a particular country so as not to spread your budgets too thin, especially if it requires more language services. Enhance Marketing Strategies: Brokers need to focus on building a brand and not solely rely on digital optimization and return on advertising spend (ROAS).The Long-Term Outlook

The rise of neo brokers and fintech apps represents both a challenge and an opportunity for FX/CFD brokers. The challenge lies in adapting to a rapidly evolving market where customer expectations are shaped by tech-driven innovations. Regardless of whether these companies offer forex and cfd products, these companies will make it extremely difficult for current forex and cfd brokers to scale and attract customers. As these new entrants continue to grow their users bases and offer more products and thus take up mindshare it will become increasingly difficult for traditional forex and cfd brokers to scale. However, for brokers willing to innovate and expand, the opportunity to capture a share of the growing retail investment market remains significant.

Ultimately, the success of FX/CFD brokers will depend on their ability to think beyond traditional boundaries and embrace a broader vision of financial services. The competitive landscape has shifted—and the time to adapt is now.

This article was written by Sameer Bhopale at www.financemagnates.com.Retail FXRead More

You might also be interested in reading Fiat Republic announces $3.5m in funding from Speedinvest, Seedcamp and Credo Ventures to bridge the gap between web3 and banking.