The Australian Contract for Difference (CFD) trading platform Mitrade has implemented an Excess of Loss Insurance Policy through Lloyd’s of London, adding to its existing security framework for retail traders.

This places it among the retail brokers in the sector that, in addition to regulation-mandated safeguards, offer their clients additional capital protection.

Mitrade’s Client Protection with Million-Dollar Insurance Coverage

The new insurance coverage, capped at AUD 1,000,000, applies to qualifying claims in the event of company insolvency and is provided without additional charges to platform users. This measure supplements the mandatory protections already in place under Australian regulatory requirements.

“Australia’s CFD trading market is built on a strong regulatory framework, continually evolving under ASIC’s oversight,” said Elven Jong, CEO of Mitrade Australia. “While these standards offer substantial trader protections, our Excess of Loss Insurance provides an additional safeguard beyond compliance.”

The development coincides with increased retail trading activity in Australia’s forex and cryptocurrency markets. Industry data indicates growing participation rates among retail investors, supported by digital platform accessibility and expanding financial education resources.

“We understand traders seek enhanced fund security and comprehensive education and resources to navigate market complexities. Our commitment reflects the broader industry shift towards proactive trader support, resilience, and risk mitigation.”

Operating under ASIC regulation, Mitrade also maintains standard security measures including segregated client funds and professional indemnity insurance. In mid-last year, the company also obtained a new license from the Cyprus Securities and Exchange Commission (CySEC), enabling its entry into the European Union market.

Who Else Offers Additional Insurance?

In recent months, Finance Magnates has reported multiple times on brokers introducing additional insurance to their offerings. In August 2024, both ATFX and Hantec Markets launched similar initiatives almost simultaneously.

ATFX introduced the ATFX Client Funds Insurance, a policy providing coverage for client funds up to $1,000,000 per claimant. Meanwhile, Hantec Markets offered protection of up to $500,000.

Additionally, EC Markets has implemented a similar solution, safeguarding client funds up to $1,000,000 per claimant.

“Typically, investor protection funds cover a limited amount. EC Markets’ insurance, by contrast, extends this coverage up to $1 million per Claimant, providing a substantial safety buffer,” said Nick Xydas, Group Marketing Director of EC Markets.

Joining this group in October, VT Markets also unveiled an additional insurance policy covering the same amount.

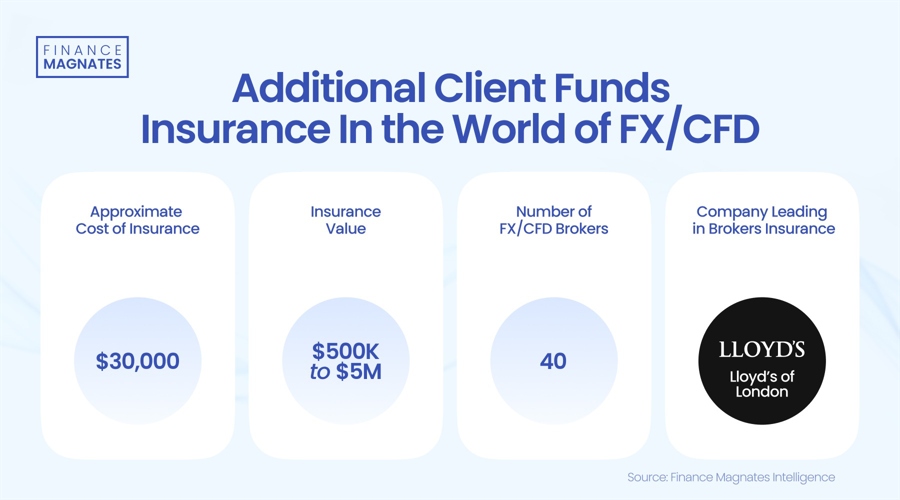

Brokers Pay $30,000+ for Enhanced Client Fund Insurance

In a conversation with Finance Magnates, VT Markets shared some details about how these types of insurance policies work.

“The value of such coverage lies in its ability to address catastrophic events that might exceed standard fund limits,” said VT Markets.

The approximate annual cost is around $30,000, and, as seen in the examples above, most brokers opt for coverage provided by Lloyd’s of London. The bank confirmed to Finance Magnates that it currently collaborates with around 40 retail trading companies.

“Each policy is tailored specifically to the broker’s unique risk profile, client demographics and operational needs,” Lloyd’s commented. “Customization ensures that the coverage meets the precise requirements of each firm.”

This article was written by Damian Chmiel at www.financemagnates.com.BrokersRead More

You might also be interested in reading Yuga Labs Hopes to Rile Up Its Bored Apes With Latest Otherside Demo.