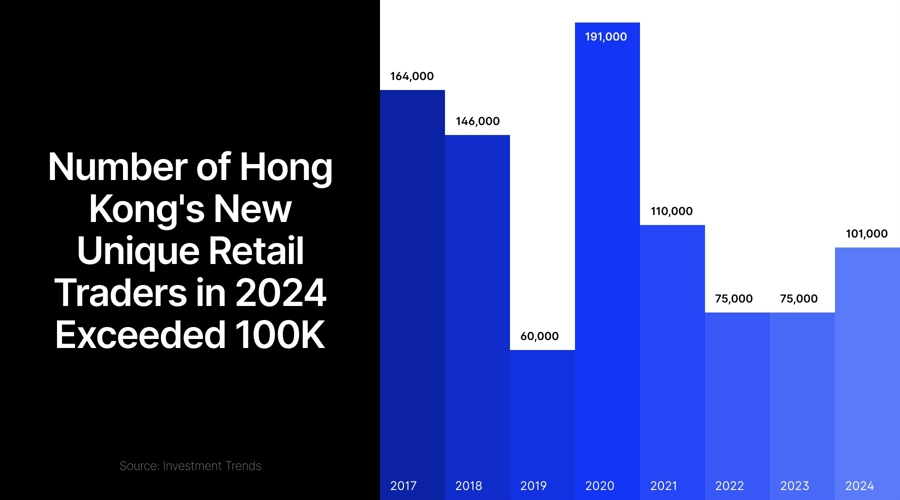

Hong Kong’s retail investment landscape is witnessing a visible transformation. The market has recorded 50,000 previously dormant trading accounts springing back to life, marking a decisive shift in investor sentiment. This revival represents a 3% increase in total retail online investors and successfully breaks a three-year declining trend.

Hong Kong’s Online Trading Market Shows Recovery as AI Adoption Surges

The resurgence coincides with a growing embrace of artificial intelligence (AI) tools among local investors. Current data shows that 17% of traders are already leveraging AI-powered solutions in their investment decisions. More significantly, an additional 43% of investors have expressed keen interest in incorporating these technologies into their trading strategies.

Despite maintaining its position as the largest market for international share trading among studied regions, Hong Kong investors display a notable confidence gap. Local traders report the lowest confidence levels compared to their global counterparts, with only one-sixth considering themselves proficient in trading activities. The majority still identify themselves as novices or beginners in the investment landscape.

“AI is redefining the retail online investing experience in Hong Kong,” says Lorenzo Vignati, Associate Director at Investment Trends. “It’s empowering investors to overcome confidence gaps, signaling the rise of a more informed and proactive investor base.”

The integration of AI tools appears to be addressing this confidence deficit. Early adopters report enhanced decision-making capabilities and improved market analysis, suggesting a potential shift in investor sophistication levels in the coming months.

Market Dynamics and Mobile-First Evolution

The total number of unique individual traders, those who made at least one transaction in the past 12 months, reached 865,000 in 2024, higher from 2023, but down from the pandemic peak of 960,000. During the reported period, the number of new investors exceeded 100,000. Meanwhile, dormant clients saw the largest increase, reaching 96,000—the highest value since 2021.

A significant transformation is also occurring in broker selection criteria, where mobile app functionality has emerged as the primary consideration, superseding traditional factors like pricing. This shift reflects a broader trend toward digital-first investing experiences, with investors increasingly demanding sophisticated mobile platforms that offer advanced features and seamless user experiences.

Reactivated investors are not just returning to the market—they are doing so with a sharper focus on aligning their strategies to shifting economic conditions,” commented Vignati. “As they navigate evolving opportunities, these investors are increasingly attuned to the dynamics of both the local and U.S. economies, showcasing a more globally aware and strategic approach to investing.”

Investment Trend recently published a report on another thriving Asian market, Singapore. The number of unique active traders in the leveraged market there fell to its lowest level since 2019, dropping to 38,000 out of a total base of 83,000.

International Trading Leadership

Hong Kong’s dominance in international share trading continues to strengthen, with over half a million active participants. More than 20% of investors now utilize specialist brokers, attracted by cost-effective access to U.S. markets and enhanced trading platforms. This trend underscores Hong Kong’s role as a global financial hub and its investors’ increasing sophistication in navigating international markets.

“This leadership position highlights the global outlook of Hong Kong online investors,” noted Vignati. “Their willingness to embrace cost-efficient platforms and diversify internationally demonstrates both their adaptability and readiness to capitalise on global market opportunities.”

The report also highlights a growing preference for diversified international portfolios, with U.S. markets remaining a primary focus for Hong Kong investors. This international outlook, combined with technological adoption, positions Hong Kong’s retail trading community at the forefront of global market participation.

Finance Magnates reported last week that the local Securities and Futures Commission introduced a simplified licensing framework for virtual asset trading platforms (VATPs), reflecting a notable development in the region’s evolving cryptocurrency regulatory environment in recent months.

This article was written by Damian Chmiel at www.financemagnates.com.AnalysisRead More

You might also be interested in reading Audit firm Mazars to verify KuCoin’s proof of reserves.