European digital broker Trade Republic reported its assets under management have exceeded 100 billion euros ($109 billion) as its customer base doubled to 8 million in the past year, the company announced on Thursday.

Trade Republic Assets Hit €100 Billion as Customer Base Doubles

The Berlin-based fintech is expanding its physical presence by establishing national branches in France, Spain, and Italy, while introducing localized banking services in these markets.

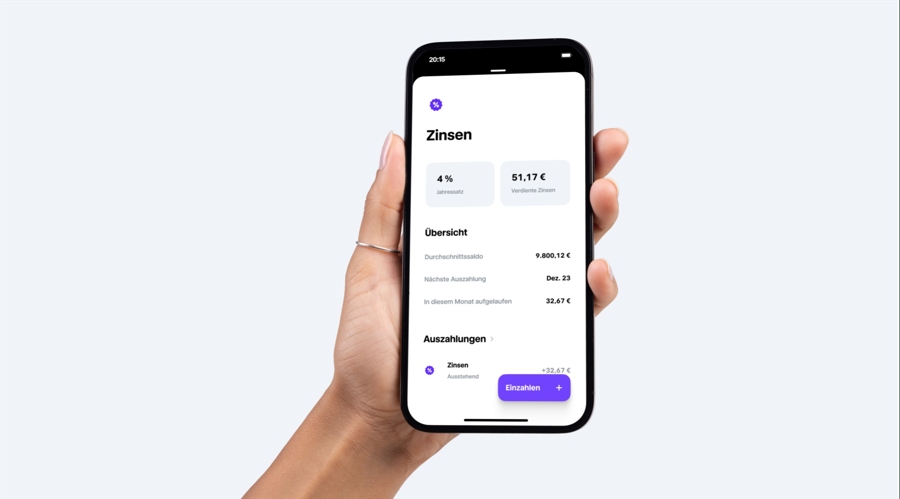

The company maintained profitability through both fiscal and calendar year 2024 while continuing to offer competitive rates aligned with the European Central Bank’s benchmark rate of 3% on customer deposits.

Trade Republic’s French operations have attracted more than 1 million customers, with the company introducing commission-free savings plans for France’s tax-advantaged PEA accounts. French customers will receive access to domestic current accounts with national IBANs.

It is worth noting that a year ago, the company was celebrating the 4 million customer mark and 30 billion euros under management.

“A new generation of savers is emerging across Europe, taking charge of their own finances. A large portion of these customers are taking their first steps with Trade Republic. In just six years, these customers have saved over 100 billion euro with us. This highlights the scale of this movement and its potential for the future,” says Christian Hecker, co-founder of Trade Republic.

International customers now comprise more than one-third of the company’s user base. The expansion of services includes a debit card program and current accounts, which have contributed significantly to the firm’s growth in 2024.

The company operates across 17 European countries, offering services including savings plans, fractional trading of shares, ETFs, bonds, derivatives, and cryptocurrency investments. Trade Republic is supervised by Germany’s Federal Financial Supervisory Authority (BaFin) and Deutsche Bundesbank.

“2024 was a year of significant investment in our infrastructure. With the establishment of national bank branches and our own securities settlement system, we have built a European platform. As the first truly European bank, we aim to offer the most attractive local banking and savings products in every market,” added Hecker.

Four years ago, the brokerage drew widespread attention for imposing restrictions on its users, preventing them from purchasing highly sought-after meme stocks like GameStop and AMC. This move, reminiscent of the actions taken by Robinhood during the same period, was met with significant backlash from investors and the broader trading community

This article was written by Damian Chmiel at www.financemagnates.com.BrokersRead More

You might also be interested in reading Beam Wallet Version 6.1 Launches on Mainnet!.